Have you ever wondered how laws shape your financial opportunities, particularly in the realm of credit? The Equal Credit Opportunity Act (ECOA) stands as a pivotal piece of legislation designed to ensure fair treatment for all consumers seeking credit. Yet, many remain unaware of how this law can be a powerful tool in improving their credit scores and securing better financial terms. What specific protections does ECOA offer, and how can these provisions directly impact your financial health?

Navigating the complexities of credit and lending can be daunting, especially when faced with unfair practices. Equal Credit Opportunity Act addresses these challenges by prohibiting discrimination and promoting equal access to credit, regardless of race, color, religion, national origin, sex, marital status, age, or dependency on public assistance. But how does this translate into tangible benefits for you, and what steps can you take if you suspect discriminatory practices in your credit dealings? This exploration will clarify these questions and empower you with knowledge to leverage your rights under ECOA for better credit opportunities.

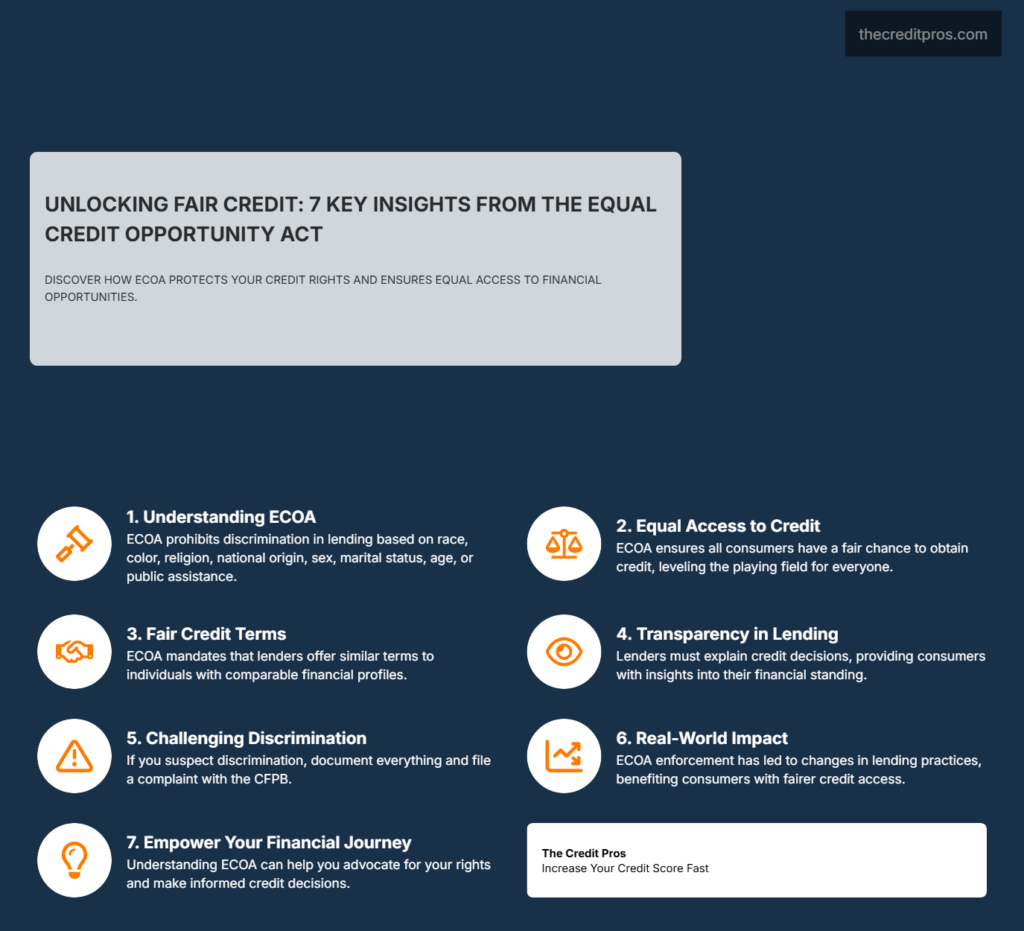

Understanding ECOA: A Deep Dive into Its Provisions

El Equal Credit Opportunity Act (ECOA) is a fundamental piece of consumer credit law in the United States, designed to prevent discrimination in lending. It ensures that all consumers are given an equal chance to obtain credit, without being judged by anything other than their financial qualifications. The Act specifies several protected classes, including race, color, religion, national origin, sex, marital status, age, and those receiving public assistance.

This legislation is crucial because it directly affects the criteria lenders can use when making decisions about credit applications. For instance, a lender cannot deny credit to a woman based on her gender or to an individual because they receive income from public assistance programs like Social Security. Understanding these provisions is the first step in recognizing when your rights might be being violated, and how you can protect yourself.

The Impact of ECOA on Credit Access and Terms

Equal Credit Opportunity Act plays a pivotal role in how credit access and terms are structured for consumers. By prohibiting discrimination, the Act ensures that all individuals have fair access to credit, which is crucial for major purchases like homes or cars, and for managing personal finances. This access to credit also extends to receiving fair terms on loans. For example, two individuals with similar financial profiles should receive similar interest rates and loan terms, regardless of their race or gender.

The implications of this are significant:

- Equal Treatment: Lenders must treat all credit applications with the same criteria, which levels the playing field.

- Better Credit Offers: With discrimination out of the equation, consumers can focus on improving their financial habits to secure better credit offers.

- Transparency: Lenders are required to explain any credit decision, providing consumers with better insights into their financial standing.

Leveraging ECOA for Credit Improvement

To leverage ECOA for improving your credit, start by being vigilant about how credit decisions are made by your lenders. If you suspect any form of discrimination, Equal Credit Opportunity Act provides a framework to challenge these decisions:

- Document Everything: Keep records of all your credit applications, the responses you receive, and any interactions with financial institutions.

- File Complaints: If you believe a lender has violated your ECOA rights, file a complaint with the Consumer Financial Protection Bureau (CFPB) or the appropriate regulatory agency.

- Seek Legal Advice: In cases where discrimination is evident, consulting with a legal expert who specializes in consumer credit laws can be beneficial.

Here are some practical steps to take if facing credit discrimination:

- Review the lender’s reasons for credit denial or unfavorable terms.

- Compare these reasons with your credit report and financial information.

- Seek clarification from the lender if the reasons are ambiguous or unsatisfactory.

ECOA in Action: Real-World Applications and Success Stories

Real-world applications of ECOA have shown its effectiveness in combating discriminatory practices. For instance, several major banks have been fined and required to change their lending practices after investigations found that they had violated Equal Credit Opportunity Act by charging higher rates to minority borrowers than was justified by their creditworthiness.

El CFPB actively enforces Equal Credit Opportunity Act, ensuring that consumers are not only aware of their rights but also have the means to assert them. This enforcement has led to better training for lenders and increased transparency in the lending process, which benefits all consumers by improving their access to fair credit.

Success stories often include consumers who:

- Challenged credit decisions and had them reversed.

- Received compensation for discrimination.

- Saw improvements in their credit terms after proving a violation of ECOA.

These cases highlight the importance of understanding and utilizing Equal Credit Opportunity Act to protect your credit rights. By ensuring you are treated fairly, you can maintain a healthier credit profile, which opens up better financial opportunities.

Conclusion: Harnessing ECOA for Financial Empowerment

The Equal Credit Opportunity Act (ECOA) serves as a crucial regulatory measure, ensuring fair access to credit and enhancing financial opportunities. By prohibiting discrimination based on race, gender, and other protected classes, ECOA levels the playing field, allowing individuals to be evaluated based on their financial qualifications. This not only assists in securing fair credit terms but also supports effective management and improvement of credit scores. Understanding and utilizing the protections offered by Equal Credit Opportunity Act can lead to more equitable treatment and transparent lending practices, which are essential for building a strong financial foundation.

As you navigate your credit journey, remember that ECOA is there to protect your rights. Being vigilant and informed can significantly influence how you interact with lenders and manage your credit health. The act’s practical applications show its effectiveness in combating discriminatory practices, making it a crucial part of your financial toolkit. Armed with this knowledge, you’re better equipped to challenge unfair practices and advocate for your financial rights. Let the principles of fairness and equal opportunity under Equal Credit Opportunity Act guide you towards more informed and empowered financial decisions.