When it comes to applying for a loan or a mortgage, most people are familiar with the term “credit score.” However, another equally important factor that lenders consider is your debt-to-income ratio, or DTI. Understanding the dynamic between DTI vs Credit Score can help you better prepare for financial decisions and improve your chances of loan approval.

Understanding DTI (Debt-to-Income Ratio)

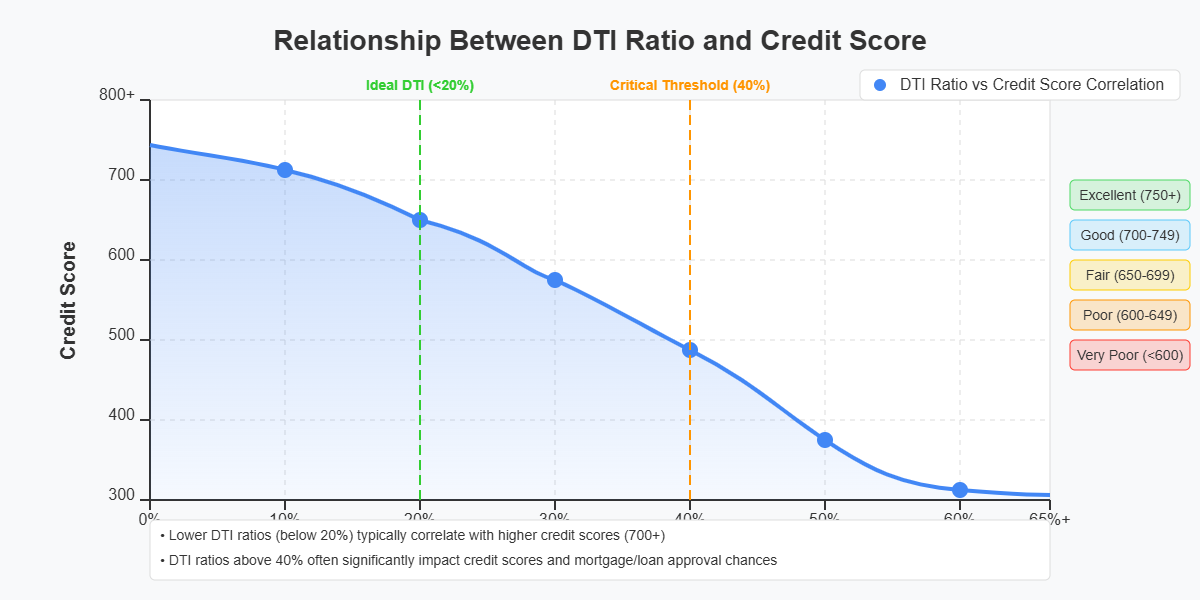

Your DTI ratio measures the amount of your monthly income that goes toward paying debts. It is calculated by dividing your total monthly debt payments by your gross monthly income. A lower DTI ratio suggests that you have a manageable level of debt, which lenders often see as a positive sign. In the debate of DTI vs Puntaje de crédito, DTI gives insight into your current financial obligations rather than your past borrowing behavior.

Understanding Credit Score

A credit score is a number that represents your creditworthiness. It is based on your credit history, including your payment history, amounts owed, length of credit history, new credit, and credit mix. Credit scores usually range from 300 to 850. In the conversation about DTI vs Credit Score, the credit score reflects your track record with borrowing and repaying debts over time.

Which One Matters More to Lenders?

In the comparison of DTI vs Credit Score, both metrics play crucial roles, but their importance can vary depending on the type of loan. For mortgages, DTI is often more heavily weighted because it reflects your ability to manage new monthly payments. However, for personal loans or credit cards, your credit score may carry more weight since it shows your credit history and likelihood of repayment.

How Lenders Use DTI and Credit Score Together

Lenders rarely look at just one factor when evaluating your application. Instead, they consider DTI vs Credit Score in tandem to get a complete picture of your financial health. For example, even if you have a high credit score, a high DTI ratio might cause lenders to worry that you’re overextended. Similarly, if you have a low DTI ratio but a poor credit score, they may question your repayment reliability.

Improving Your Financial Profile

If you want to improve your chances of getting approved for loans, it’s essential to work on both your DTI and credit score. Paying down existing debt can lower your DTI ratio and also improve your credit score by reducing your credit utilization. When thinking about DTI vs Credit Score, remember that improving one often has a positive effect on the other.

DTI vs Credit Score for Different Loan Types

Different types of loans place different emphasis on DTI vs Credit Score. For example, FHA loans tend to be more lenient with credit scores but have strict DTI requirements. On the other hand, unsecured personal loans may place more emphasis on your credit score. Understanding the role of DTI vs Credit Score in each loan type helps you know what to focus on when applying.

Why You Should Monitor Both Regularly

Monitoring your DTI and credit score regularly helps you stay on top of your financial health. With tools and apps available today, tracking DTI vs Credit Score has become easier than ever. Staying aware of changes and taking steps to improve both can significantly boost your chances when applying for financial products.

Final Thoughts on DTI vs Credit Score

In the debate over DTI vs Credit Score, the answer is not one-size-fits-all. Both are essential components of your financial profile and can significantly influence your ability to secure credit.

Whether you’re applying for a mortgage, car loan, or credit card, being proactive about managing both your DTI and credit score can make a big difference. Remember, DTI vs Credit Score is not about choosing one over the other but about understanding how they work together to present a clear picture of your financial responsibility.