Your credit score gets plenty of attention, but there’s a quieter factor working behind the scenes that might be just as important for your financial future. Credit age – how long you’ve had credit accounts open – influences everything from the interest rates you qualify for to whether you get approved for that dream home loan. Understanding how credit age affects financial opportunities is crucial, yet most people don’t realize how this seemingly passive element of their credit profile can either open doors or quietly close them. Understanding how credit age affects financial opportunities and borrowing power is essential for your financial future. Realizing how your credit age affects financial decisions can help you strategize better.

What makes credit age particularly interesting is that it’s not just about having old accounts sitting around. The way credit scoring models actually calculate your credit age involves complex mathematics that can surprise you, and the strategies for optimizing it go far beyond the basic advice of “keep old cards open.” When you understand how lenders really view credit age and how it affects financial reliability, you start to see why some people seem to effortlessly qualify for better terms while others struggle – even with similar credit scores.

Knowing that credit age affects financial opportunities allows you to make informed choices. The age of your credit accounts directly affects financial outcomes. This is why credit age affects financial opportunities significantly. If you want to know how credit age affects financial options, you need to understand the metrics. Many people overlook how credit age affects financial approvals. The impact of credit age on financial profiles is more significant than many realize. Credit age also affects financial products you can qualify for.

Understanding how credit age affects financial capabilities can help you manage your accounts better. Strategic management of accounts is essential, especially since credit age affects financial outcomes. Therefore, knowing how credit age affects financial health is crucial for maintaining good credit. Your credit age affects financial assessments done by potential lenders. In essence, credit age affects financial credibility during assessments. Ultimately, understanding how credit age affects financial outcomes can guide your financial choices. How credit age affects financial decisions should be a priority for anyone looking to improve their credit score.

As you build your credit, remember that credit age affects financial leverage in the long run. Long-term credit age reflects how credit age affects financial strategies adopted by lenders. Recognizing how credit age affects financial stability can influence your borrowing choices. Understanding the nuances of how credit age affects financial profiles can differentiate good borrowers from bad ones. This is why credit age affects financial health and access to credit. The interplay of credit age affects financial opportunities over your lifetime. Finally, how credit age affects financial relationships with lenders is critical to your success. Ultimately, credit age affects financial planning for the future. Being aware of how credit age affects financial decisions enables better risk management. Consequently, understanding how credit age affects financial opportunities can change your strategy. Overall, knowing how credit age affects financial decisions is vital for effective credit management. Thus, credit age affects financial access across various lending scenarios. Taking note of how credit age affects financial development can lead to improved borrowing decisions. In conclusion, credit age affects financial opportunities and decisions at every stage of life.

How Credit Age Affects Financial Health: Beyond Simple Time Calculations

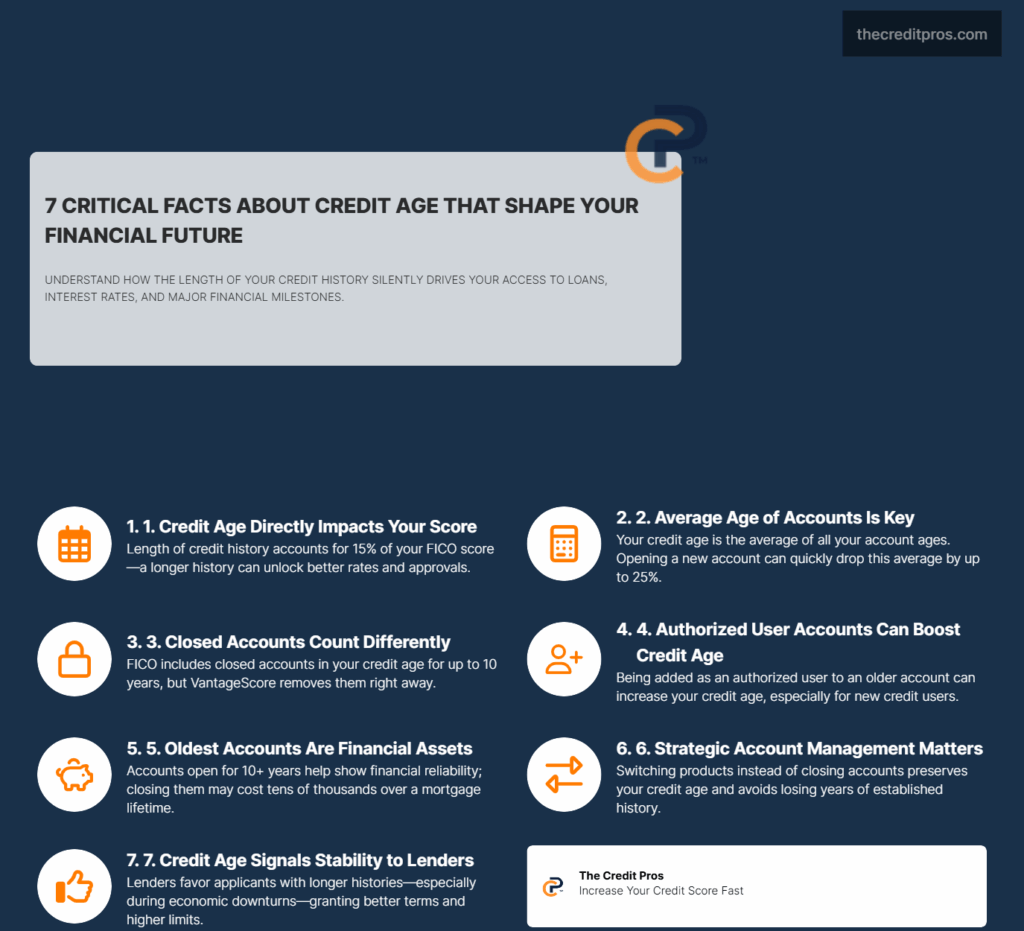

Credit age operates through sophisticated mathematical algorithms that extend far beyond counting the years since you opened your first account. Credit scoring models calculate your Average Age of Accounts (AAoA) by taking the sum of all your account ages and dividing by the total number of accounts, but this seemingly straightforward process involves nuanced considerations that can significantly impact your financial opportunities.

The distinction between your oldest account age, newest account age, and average account age creates a complex scoring framework that lenders use to assess your creditworthiness. Your oldest account establishes the foundation of your credit history, demonstrating your longest relationship with credit, while your newest account reflects recent credit-seeking behavior. The average account age, however, provides the most comprehensive view of your credit management experience over time.

FICO y VantageScore models treat closed accounts differently when calculating credit age, creating strategic implications for your long-term credit health. FICO continues to factor closed accounts into your credit age calculation for up to ten years after closure, while VantageScore immediately removes closed accounts from the average age calculation. This fundamental difference means that closing an old account could instantly reduce your credit age under VantageScore, while FICO users maintain that benefit for a decade.

The mathematical impact of opening new accounts creates an immediate dilution effect on your existing credit age average. If you have three accounts aged 5, 7, and 10 years respectively, your average account age stands at 7.3 years. Adding a new account drops this average to 5.5 years, representing a 25% reduction in your credit age that could influence your credit score and lending opportunities.

Authorized user accounts introduce additional complexity to credit age calculations, as they can artificially inflate or deflate your true credit experience. When you become an authorized user on an account that predates your own credit history, some scoring models backdate your credit age to include that account’s full history. This can provide substantial benefits for young credit users but may also mask your actual independent credit management experience from sophisticated lenders who examine your credit reports in detail.

Credit age transitions from neutral to beneficial in scoring models typically occur around the six-month mark for basic score generation, but meaningful positive impact often requires 12-24 months of established history. The specific timeframes vary by scoring model, with some algorithms providing incremental benefits as accounts age, while others feature threshold effects where credit age impact increases more dramatically at certain milestones.

Strategic Account Management: The Art of Timing Your Credit Decisions

Maintaining older accounts requires a strategic balance between preserving credit age benefits and managing the practical costs of account maintenance. Keeping old, unused accounts open serves your credit age when those accounts carry no annual fees and pose minimal security risks, but becomes counterproductive when maintenance costs exceed the credit score benefits or when unused accounts create fraud vulnerabilities.

The decision between product changes and account closures for aging credit lines involves understanding how each option affects your credit age calculation. Product changes typically preserve your account opening date and credit age benefits while allowing you to access more suitable terms or rewards structures. Account closures, conversely, may provide immediate simplification but sacrifice years of credit age that cannot be recovered once lost.

Maintaining minimal account activity on older accounts prevents automatic closures while avoiding unwanted fees or interest charges. The optimal frequency varies by issuer, but most credit card companies require activity every 6-12 months to keep accounts active. Small, recurring charges such as subscription services provide consistent activity without requiring ongoing attention, though you must ensure these charges are paid in full each month to avoid interest.

Credit limit increases on older accounts create a compound benefit that enhances both your credit age value and your overall credit utilization ratio. When you secure higher limits on your oldest accounts, you maximize the positive impact of those accounts on your credit profile. Lenders often view high-limit, long-standing accounts as strong indicators of creditworthiness and financial stability.

The strategic timing of new account openings requires careful consideration of your current credit age and upcoming financial needs. Opening multiple accounts within a short timeframe can dramatically reduce your average account age, potentially impacting your ability to qualify for major loans. Planning new account openings around significant purchases, such as home or auto loans, helps minimize the impact on your credit profile when you need optimal credit scores.

Account management strategies should also consider the long-term trajectory of your credit portfolio. Maintaining a core group of no-fee accounts indefinitely while selectively adding new accounts for specific benefits or needs creates a foundation of established credit age while allowing for portfolio optimization over time.

Credit Age as a Risk Mitigation Tool for Lenders

Lenders view longer credit histories as predictive indicators of future payment behavior because extended credit relationships demonstrate your ability to manage financial obligations across different economic conditions and life circumstances. A borrower with a 15-year credit history has weathered multiple economic cycles, job changes, and personal financial challenges, providing lenders with substantial evidence of credit management capabilities.

Credit age influences loan terms, interest rates, and credit limits through its role in comprehensive risk assessment models that extend beyond simple credit score calculations. While your credit score provides a snapshot of your current creditworthiness, your credit age offers context about the depth and consistency of your credit management experience. Lenders often reserve their most favorable terms for borrowers who combine strong credit scores with substantial credit age.

The relationship between credit age and perceived stability becomes particularly pronounced during economic uncertainty when lenders tighten their underwriting standards. Borrowers with longer credit histories often maintain access to credit and favorable terms even when newer credit users face restrictions or higher costs. This stability premium reflects lenders’ preference for established credit relationships during periods of increased economic risk.

Different types of lenders weight credit age according to their risk tolerance and business models. Traditional banks and established financial institutions typically place greater emphasis on credit age as part of conservative underwriting practices, while fintech companies and alternative lenders may focus more heavily on recent payment behavior and income verification. Understanding these preferences helps you target applications to lenders most likely to value your credit profile.

The compound effect of credit age combined with low utilization and perfect payment history creates what lenders consider an ideal credit profile. When these three factors align, they signal a borrower who not only manages credit responsibly but has done so consistently over an extended period. This combination often qualifies borrowers for premium products and exclusive lending opportunities that aren’t available through standard application channels.

Economic downturns typically increase the relative value of credit age as lenders become more risk-averse and prioritize borrowers with proven long-term stability. During the 2008 financial crisis and the 2020 pandemic-related economic disruption, many lenders tightened their credit standards and showed preference for borrowers with established credit histories, demonstrating how credit age serves as a buffer during challenging economic periods.

Accelerating Your Credit Age Strategy: Advanced Techniques for Younger Credit Profiles

Authorized user status provides one of the most effective methods for benefiting from established credit histories, but success requires strategic selection of the primary account holder and their account characteristics. The ideal authorized user arrangement involves being added to an account with a long history, low utilization, and perfect payment record. However, you must also ensure the primary account holder maintains responsible credit management, as their future behavior will continue to impact your credit profile.

The criteria for selecting beneficial authorized user accounts extend beyond simple account age to include utilization patterns, payment history, and account limits. An older account with occasional late payments may harm rather than help your credit profile, while a newer account with perfect management might provide more benefit. Additionally, some credit card issuers don’t report authorized user accounts to all credit bureaus, limiting the potential benefit.

Different account types contribute uniquely to building a robust credit age profile, with revolving credit accounts like credit cards typically providing more flexibility for credit age strategy than installment loans. Credit cards remain open indefinitely as long as you maintain them, allowing their age to continue increasing. Installment loans, such as auto loans or personal loans, close automatically when paid off, limiting their long-term contribution to your credit age.

Transitioning from authorized user status to independent credit building requires careful timing to preserve age benefits while establishing your own credit relationships. The most effective approach involves gradually building your independent credit profile while maintaining beneficial authorized user accounts. This strategy allows you to develop your own credit management experience without sacrificing the credit age advantages provided by the authorized user relationship.

Timeline expectations for meaningful credit age improvements require patience, as this factor develops slowly compared to other credit score components. While payment history and credit utilization can improve within months, credit age benefits accumulate gradually over years. Most borrowers begin seeing modest benefits from credit age after 12-24 months, with more substantial impact developing after 3-5 years of established credit history.

The 15% credit score impact of length of credit history becomes more significant as your overall credit profile matures and other factors stabilize. For borrowers with limited credit history, focusing primarily on payment history and utilization provides faster score improvements. However, as these factors optimize, credit age becomes increasingly important for achieving the highest credit score ranges that unlock premium financial opportunities.

Long-Term Wealth Building Through Credit Age Optimization

The financial savings generated by improved credit age compound over decades through consistently better loan terms across multiple major purchases and refinancing opportunities. A borrower with excellent credit age may qualify for mortgage rates that are 0.25-0.50 percentage points lower than someone with similar credit scores but shorter credit history. On a $300,000 mortgage, this difference translates to $30,000-$60,000 in interest savings over the loan’s lifetime.

Credit age affects your ability to qualify for premium financial products that aren’t available to borrowers with shorter credit histories, regardless of their credit scores. These products often include high-limit credit cards with exceptional rewards programs, private banking services, and exclusive lending programs with preferential terms. Access to these opportunities can provide ongoing financial advantages that extend far beyond simple interest rate savings.

The compounding effect of credit age on major financial milestones becomes particularly evident in business financing and investment property purchases, where lenders scrutinize credit profiles more intensively. Entrepreneurs and investors with substantial credit age often find it easier to secure favorable terms for business loans, equipment financing, and investment property mortgages. This advantage can accelerate wealth building by reducing financing costs and improving cash flow on income-producing assets.

Building a credit portfolio that strengthens over time requires strategic planning that balances immediate needs with long-term optimization. The most effective approach involves establishing a foundation of no-fee credit accounts early in your financial journey and maintaining these accounts indefinitely while selectively adding new accounts for specific benefits or changing needs.

The lifetime financial impact of maintaining older accounts often substantially exceeds the convenience benefits of simplifying your credit profile. While managing multiple credit accounts requires more attention and organization, the long-term financial advantages typically justify this additional complexity. Borrowers who maintain their oldest accounts often enjoy preferential treatment from lenders and access to financial opportunities that aren’t available to those with shorter credit histories.

Strategic credit building positions you for optimal financial flexibility in later decades when major life events such as retirement planning, estate management, and family financial support require access to various credit products and services. The credit age you build today creates the foundation for financial opportunities that may not be immediately apparent but become valuable as your financial needs evolve and grow more sophisticated over time.

The Long Game: Why Credit Age Matters More Than You Think

Credit age operates as your financial reputation’s backbone, quietly influencing every major lending decision throughout your lifetime. While other credit factors can be improved relatively quickly, the depth and stability that comes from established credit relationships can’t be rushed or replicated. The mathematical complexity behind credit age calculations means that strategic account management today creates compounding benefits that extend far beyond simple credit scores – from mortgage rates that save tens of thousands of dollars to exclusive financial opportunities that aren’t available to borrowers with shorter histories.

The borrowers who seem to effortlessly qualify for premium terms aren’t just lucky; they’ve understood that credit age serves as a risk mitigation tool that lenders value increasingly during uncertain economic times. Your oldest accounts aren’t just numbers on a credit report – they’re evidence of your financial resilience across market cycles, job changes, and life transitions. The question isn’t whether you can afford to maintain those aging accounts, but whether you can afford the decades of lost financial opportunities that come from closing them.