Finding yourself drowning in debt can feel overwhelming, especially when you’re bombarded with promises from credit counseling services that sound too good to be true. The reality is that not all credit counseling agencies are created equal – some are legitimate nonprofits genuinely focused on helping you regain financial stability, while others are predatory operations designed to profit from your desperation. Understanding the difference between these two types of services can mean the difference between genuine financial recovery and falling deeper into debt.

Choosing the right credit counseling service is essential to ensure you receive the help you need. Researching the right credit counseling service can lead to improved financial health. Finding the right credit counseling service may involve checking their accreditation. Many agencies offer the right credit counseling service, but not all deliver quality results. Understanding local regulations can help you select the right credit counseling service. Consider the reputation of the right credit counseling service before making a decision. Choosing the right credit counseling service requires understanding their counselor qualifications.

The process of selecting the right credit counseling service goes far beyond simply choosing the first agency that appears in your search results. You need to understand certification requirements, fee structures that make sense, and how to spot red flags that indicate potential scams. What questions should you ask during initial consultations to determine if an agency truly has the expertise to handle your specific situation? How do you verify that their promises about debt reduction timelines are realistic rather than marketing hype? The answers to these questions will determine whether your investment in credit counseling leads to lasting financial health or costly disappointment.

Comparing costs will help you find the right credit counseling service for your needs. The right credit counseling service should not charge upfront fees for initial consultations. Look for the right credit counseling service that fits your financial situation and needs. Effective negotiation is key to finding the right credit counseling service to assist you. Identifying fee structures can help ascertain the right credit counseling service for you.

Decoding the Certification Maze: Understanding Accreditation Standards

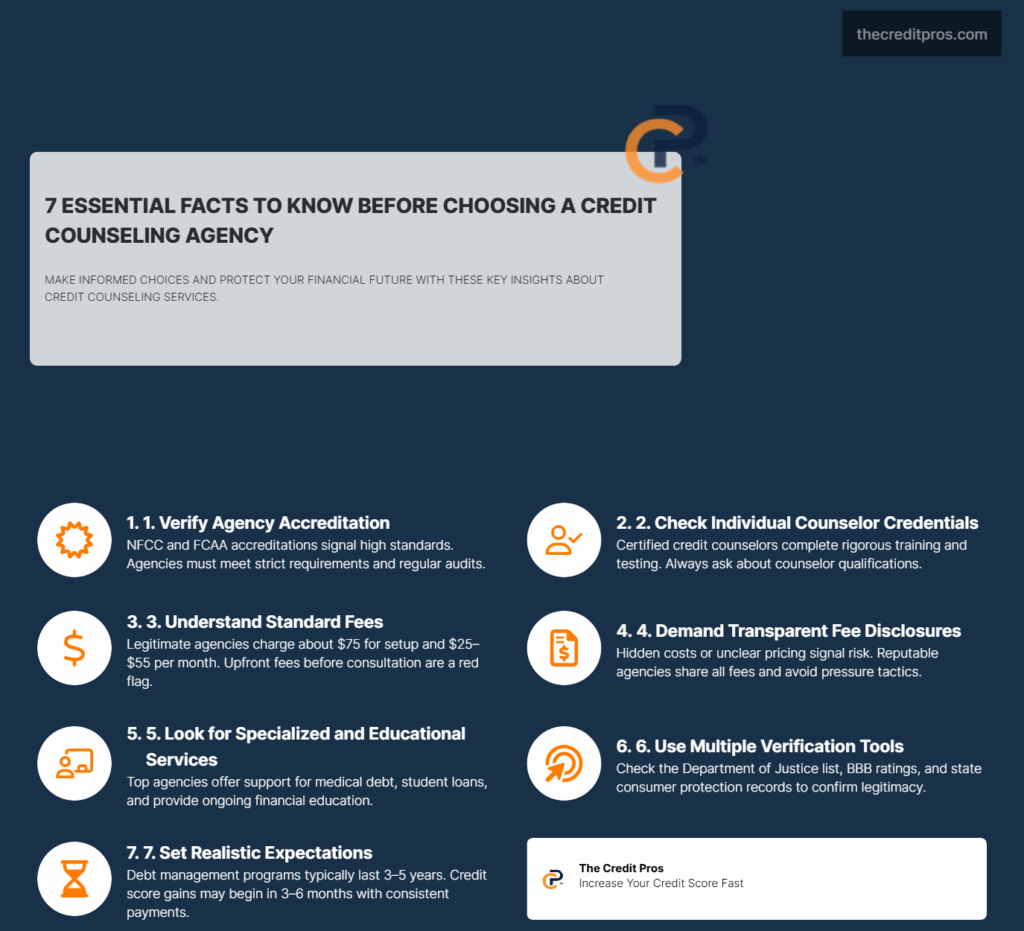

Understanding the services offered by the right credit counseling service is crucial for success. The landscape of credit counseling certifications extends far beyond the basic credentials displayed on agency websites. The National Foundation for Credit Counseling (NFCC) and Financial Counseling Association of America (FCAA) represent the gold standard in agency accreditation, but understanding their certification requirements reveals crucial differences in service quality and counselor expertise. NFCC member agencies must demonstrate comprehensive financial counseling capabilities, maintain strict ethical standards, and provide ongoing counselor education, while FCAA certification focuses on evidence-based counseling practices and measurable client outcomes.

State-by-state variations in credit counseling regulations create a complex regulatory environment that significantly impacts consumer protection. Some states require additional licensing beyond federal certification, while others rely primarily on federal oversight through the U.S. Department of Justice’s approved agency list. These regulatory differences affect everything from fee structures to service offerings, with states like California and New York maintaining stricter consumer protection standards than federal minimums require.

The verification process through the Department of Justice’s approved agency list serves as your primary defense against fraudulent operations, but legitimate agencies may not always appear in certain databases due to timing issues or administrative delays. Agencies approved for bankruptcy counseling services undergo rigorous financial audits and demonstrate proven track records of successful debt management, making this list particularly valuable for consumers seeking comprehensive financial guidance. However, newer agencies or those specializing in specific services may maintain excellent standards while still completing the lengthy approval process.

Individual counselor certifications differ substantially from agency accreditations, creating potential gaps in service quality even within certified organizations. Certified credit counselors must complete extensive training programs, pass comprehensive examinations, and maintain continuing education requirements, but agency certification doesn’t guarantee that all counselors meet these individual standards. The most reputable agencies employ only certified counselors and provide regular training updates, while less scrupulous operations may mix certified and non-certified staff without clear disclosure to clients.

Work with the right credit counseling service to create a personalized financial plan. Choosing the right credit counseling service can help tackle diverse debt obligations. Consider a comprehensive approach with the right credit counseling service for better results. The right credit counseling service will help you improve your financial literacy. Utilize the right credit counseling service to navigate financial challenges effectively.

Understanding Credit Counseling Costs and Fee Structures

Transparency in operations is a hallmark of the right credit counseling service. Be sure to conduct due diligence when selecting the right credit counseling service. Evaluating complaint patterns can guide you to the right credit counseling service. Initial assessments from the right credit counseling service should be thorough and informative. Consider geographic factors when selecting the right credit counseling service for assistance. Ensure the right credit counseling service provides clear information about fees and services. Setting realistic expectations with the right credit counseling service is essential for success. Graduation criteria should be set clearly with the right credit counseling service from the start.

The industry standard application fee of approximately $75 and monthly fees ranging from $25 to $55 reflect the genuine operational costs of providing comprehensive credit counseling services. These fees support essential services including creditor negotiations, payment processing, ongoing counseling sessions, and administrative overhead required to maintain agency operations. Understanding these cost structures helps you evaluate whether an agency’s pricing aligns with industry standards and service quality expectations.

Free initial consultations represent a fundamental principle of legitimate nonprofit credit counseling, serving as both a consumer protection measure and a practical assessment tool. During these sessions, qualified counselors review your complete financial situation, explain available options, and develop preliminary action plans without any financial commitment. Any agency requesting payment before this initial consultation violates industry standards and likely operates as a for-profit entity disguised as a nonprofit service.

The correlation between agency size and fee structures reveals important insights about service quality and sustainability. Larger agencies often achieve economies of scale that enable lower fees while maintaining comprehensive services, but smaller agencies may provide more personalized attention despite higher costs. National agencies typically offer standardized fee structures and consistent service quality across locations, while regional agencies may adjust pricing based on local economic conditions and competition levels.

Future planning is vital, and the right credit counseling service can help you navigate these aspects. Choosing the right credit counseling service is crucial for making informed decisions moving forward. Debt management plan economics depend heavily on agencies’ negotiating power with creditors, which varies significantly based on agency size, reputation, and historical payment performance. Established agencies with strong creditor relationships often secure better interest rate reductions and fee waivers, translating directly into greater savings for clients. The most effective agencies maintain dedicated creditor relations teams that continuously negotiate improved terms and monitor changing creditor policies that affect client outcomes.

Fee Structure Red Flags:

- Upfront payments required before consultation

- Fees significantly above or below industry standards

- Unclear fee disclosures or hidden charges

- Pressure to enroll in fee-based services immediately

- Promises of specific savings amounts without financial review

Specialized Services for Complex Financial Situations

Modern credit counseling extends far beyond traditional budget planning to encompass sophisticated debt management strategies tailored to specific financial challenges. Advanced agencies provide specialized services for complex situations including medical debt negotiations, student loan consolidation guidance, and coordinated approaches to multiple debt types that require different resolution strategies. These comprehensive services address the reality that most consumers face diverse debt obligations requiring nuanced approaches rather than one-size-fits-all solutions.

Credit report analysis and dispute resolution services within counseling programs offer integrated approaches to financial recovery that address both immediate debt concerns and long-term credit health. Qualified counselors identify reporting errors, guide dispute processes, and develop strategies for managing negative information that cannot be removed. This comprehensive approach recognizes that credit improvement requires both debt reduction and active credit report management to achieve optimal results.

Educational workshops and long-term financial literacy development programs distinguish superior agencies from basic service providers. The most effective programs include ongoing education components that address financial planning, investment basics, homeownership preparation, and retirement planning concepts that support sustained financial health. These educational initiatives recognize that temporary debt relief without underlying financial knowledge changes often leads to recurring debt problems.

Specialized programs for specific demographics reflect the unique financial challenges faced by military personnel, seniors, and immigrant communities. Military-focused programs address deployment-related financial issues, VA benefit optimization, and military-specific debt challenges, while senior programs focus on fixed-income budgeting, Medicare planning, and estate considerations. Immigrant-focused services often include credit establishment guidance, remittance planning, and navigation of financial systems that may differ significantly from clients’ home countries.

Technology integration in modern credit counseling includes mobile apps for budget tracking, online educational resources, and automated monitoring services that provide ongoing support between counseling sessions. The most advanced agencies offer comprehensive digital platforms that integrate with clients’ financial accounts, provide real-time spending analysis, and deliver personalized recommendations based on individual progress patterns. These technological enhancements extend counseling effectiveness beyond traditional appointment-based models.

Due Diligence Strategies for Agency Selection

Comprehensive background checking requires consultation of multiple verification sources beyond basic certification databases. The Better Business Bureau provides complaint history and resolution patterns, while state consumer protection offices maintain records of enforcement actions and consumer alerts specific to credit counseling services. State attorney general offices often publish consumer guides and warning lists that identify problematic agencies and highlight emerging scam patterns in the credit counseling industry.

Interpreting complaint patterns and resolution rates requires understanding the context behind consumer grievances and agency responses. High complaint volumes may indicate poor service quality, but they could also reflect the agency’s size and client base characteristics. More importantly, examine how agencies respond to complaints, their resolution timeframes, and whether patterns suggest systemic issues or isolated incidents. Agencies with strong complaint resolution processes demonstrate commitment to client satisfaction and service improvement.

Initial consultation assessment criteria should evaluate both the depth of financial analysis and the quality of recommendations provided. Qualified counselors conduct comprehensive income and expense reviews, analyze debt-to-income ratios, and provide detailed explanations of available options with realistic outcome projections. During these consultations, assess whether counselors ask probing questions about your financial goals, explain the pros and cons of different approaches, and avoid high-pressure sales tactics for fee-based services.

Geographic considerations affect both service accessibility and regulatory oversight, with local agencies offering potential advantages in understanding regional economic conditions and creditor practices. However, national agencies may provide more standardized service quality and greater resources for complex situations. Consider your preference for in-person meetings versus remote consultations, as well as the agency’s ability to accommodate your schedule and communication preferences throughout the counseling relationship.

Warning signs during the vetting process include reluctance to provide detailed fee information, inability to explain certification status clearly, and promises of specific outcomes without thorough financial analysis. Legitimate agencies provide transparent information about their services, fees, and success rates while acknowledging that individual results vary based on specific circumstances. Be particularly cautious of agencies that guarantee specific credit score improvements or debt reduction percentages without reviewing your complete financial situation.

Setting Realistic Expectations and Monitoring Progress

Realistic timelines for debt reduction and credit score improvement depend on multiple factors including debt amounts, income stability, and the severity of existing credit damage. Most debt management plans require three to five years for completion, while credit score improvements typically begin within three to six months of consistent payment performance. Understanding these timeframes prevents unrealistic expectations and helps you evaluate whether agency promises align with industry standards and your specific financial situation.

Key performance indicators for tracking counseling effectiveness include debt reduction progress, payment consistency rates, credit score changes, and achievement of specific financial goals established during initial consultations. The most effective agencies provide regular progress reports, quarterly reviews, and adjusted strategies based on changing circumstances. These monitoring systems ensure that counseling relationships remain productive and responsive to evolving financial needs.

The relationship between credit counseling participation and future lending opportunities requires careful consideration of both benefits and potential limitations. While debt management plans may temporarily restrict access to new credit, successful completion demonstrates financial responsibility to future lenders. Some lenders view credit counseling participation positively as evidence of proactive financial management, while others may require waiting periods after program completion before approving new credit applications.

Exit strategies and graduation criteria from debt management programs should be clearly defined at program initiation and regularly reviewed throughout the counseling relationship. Successful graduation typically requires completion of all enrolled debts, demonstration of independent budget management skills, and establishment of emergency savings funds. The most comprehensive programs include post-graduation support services and resources for maintaining financial stability without ongoing professional assistance.

Long-term financial health maintenance extends beyond debt elimination to encompass ongoing financial planning, investment strategies, and preparation for major life changes that could affect financial stability. Superior agencies provide resources and referrals for advanced financial planning services, recognizing that credit counseling represents one phase of a lifelong financial management journey. This forward-thinking approach ensures that clients develop sustainable financial habits that prevent future debt problems and support continued prosperity.

Making Your Credit Counseling Decision: The Path Forward

The difference between legitimate credit counseling and predatory schemes isn’t just about certification badges or fee structures – it’s about finding the right credit counseling service that truly understands your unique financial situation and provides realistic, sustainable solutions. The most successful credit counseling relationships combine proper agency credentials with personalized service delivery, transparent communication, and realistic timelines that align with your specific circumstances. By thoroughly vetting agencies through multiple verification sources, understanding industry-standard fee structures, and setting appropriate expectations for debt reduction timelines, you’re positioning yourself for genuine financial recovery rather than temporary relief.

Your investment in the right credit counseling service represents more than just debt management – it’s a commitment to developing the financial knowledge and habits that will serve you throughout your lifetime. The agencies worth your trust don’t just process payments to creditors; they educate you about budgeting, help you understand credit dynamics, and provide ongoing support that extends beyond program completion. When you choose wisely, the right credit counseling service becomes the foundation for lasting financial stability rather than another expense in an already strained budget. The question isn’t whether you can afford professional financial guidance – it’s whether you can afford to navigate complex debt challenges without the expertise and creditor relationships that only legitimate agencies provide.