Understanding how loans work can be a crucial step in managing your finances effectively. Amortized loans, in particular, are a common choice for many seeking predictability in their repayment plans. But what exactly makes these loans so significant? When you take out an amortized loan, you agree to a schedule that breaks down each payment into principal and interest. This structured approach allows for consistent monthly payments and influences the amount of interest you’ll pay over time. Curious about how this affects your overall financial picture?

By the end of this discussion, you’ll have a clearer understanding of the mechanics behind these loans. We’ll explore how amortized loans stack up against other types, like balloon loans y revolving credit, and why they often emerge as a preferred choice for those seeking stability. Additionally, we’ll examine their impact on your credit score and how making strategic early payments can lead to significant interest savings. Whether you’re considering an amortized loan for the first time or looking to optimize existing ones, you’ll find practical insights to support your financial journey.

Understanding Amortization: Beyond the Basics

Amortization is a fundamental concept in lending, involving the gradual repayment of a loan through scheduled installments, which cover both the principal and the interest. This systematic approach ensures that over time, the borrower’s payments are split between reducing the outstanding principal and covering the accruing interest. This dual-component payment structure is key to understanding how amortized loans operate.

The amortization schedule serves as a roadmap for borrowers, illustrating how each payment is allocated over the life of the loan. It provides a detailed breakdown of each installment, showing the exact amount applied to the principal and the amount going toward interest. This visualization helps borrowers track their progress and highlights the shift in payment focus from interest-heavy to principal-heavy over time. Initially, a significant portion of each payment goes toward interest, but as the loan matures, more of each payment is directed toward reducing the principal.

Understanding the mechanics of amortization reveals its impact on the total interest paid over the loan’s duration. As borrowers make consistent payments, the principal balance decreases, leading to a reduction in the interest charged in subsequent periods. This gradual reduction in interest obligations can result in substantial savings over the life of the loan.

Comparisons: Amortized Loans vs. Other Loan Types

When evaluating loan options, it’s essential to understand how amortized loans compare to other types, such as balloon loans and revolving credit. Each loan type has distinct characteristics that can significantly impact a borrower’s financial strategy.

Balloon loans typically involve smaller periodic payments with a large final payment, known as a balloon payment, due at the end of the loan term. While this structure can offer lower monthly payments initially, it requires borrowers to be prepared for a significant lump-sum payment later. Revolving credit, such as credit cards, provides flexibility by allowing borrowers to draw against a credit limit and make variable payments. However, the lack of a fixed repayment schedule can lead to higher interest costs over time if not managed carefully.

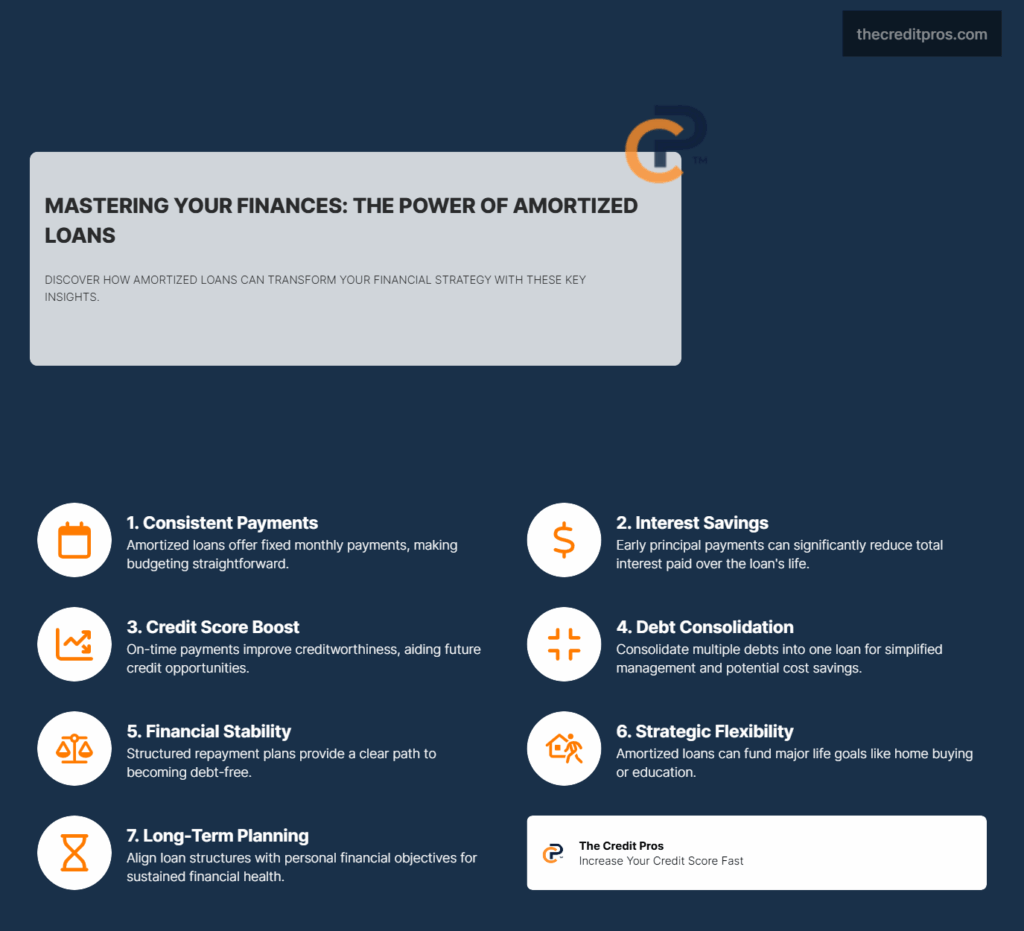

Amortized loans offer several advantages, particularly in terms of predictability and financial planning. The fixed payment structure facilitates budgeting, enabling borrowers to plan their finances with confidence. This predictability makes amortized loans an attractive option for those seeking stability and long-term financial management. In contrast, balloon loans may be suitable for borrowers anticipating a significant future cash inflow, while revolving credit can be beneficial for those needing flexible access to credit.

Key Differences:

- Amortized Loans:

- Fixed payments

- Predictable budgeting

- Long-term financial management

- Balloon Loans:

- Smaller periodic payments

- Large lump-sum payment at the end

- Suitable for anticipated future cash inflows

The Financial Impact of Amortized Loans

Amortized loans play a crucial role in shaping a borrower’s financial profile, influencing both credit scores and overall creditworthiness. Because these loans are structured with regular, predictable payments, they can positively impact a borrower’s credit score, provided payments are made on time. Timely payments demonstrate financial responsibility and can enhance a borrower’s creditworthiness, making it easier to secure favorable terms on future credit.

One of the strategic advantages of amortized loans lies in the potential to save on interest costs through early principal payments. By paying more than the required installment, borrowers can reduce the outstanding principal faster, which in turn decreases the total interest paid over the loan’s life. This proactive approach can significantly lower the overall cost of borrowing.

The long-term financial implications of choosing an amortized loan are significant. Borrowers who adhere to their repayment schedule can achieve debt-free status more predictably than with other loan types. This stability can provide a solid foundation for future financial planning, allowing individuals to allocate funds toward savings, investments, or other financial goals.

Strategic Use of Amortized Loans

Effectively managing an amortized loan requires strategic planning and a thorough understanding of loan terms and conditions. Borrowers should familiarize themselves with the specifics of their loan agreement, paying close attention to interest rates, payment schedules, and any prepayment penalties. This knowledge enables borrowers to make informed decisions about their repayment strategy and avoid unexpected expenses.

Amortized loans can also serve as powerful tools for debt consolidation and financial planning. By consolidating multiple debts into a single amortized loan, borrowers can simplify their repayment process and potentially secure a lower interest rate. This approach not only streamlines debt management but can also lead to cost savings and improved financial health over time.

Amortized loans can be leveraged to achieve broader financial objectives, such as funding education, purchasing a home, or investing in a business. By aligning the loan structure with personal financial goals, borrowers can maximize the benefits of amortization and work toward achieving long-term financial stability.

Wrapping It Up: The Significance of Amortized Loans

Amortized loans are notable for their predictability and structured repayment plans, offering stability and long-term financial management. Unlike balloon loans or revolving credit, they provide a clear, consistent payment path that simplifies budgeting and enhances creditworthiness when managed responsibly. This dependable structure allows borrowers to reduce interest costs through early payments, highlighting their role in effective financial planning.

By understanding how amortized loans work, you’re equipped to make informed decisions that align with your financial goals, whether it’s consolidating debts or funding significant life investments. As you navigate your financial journey, consider how the consistent rhythm of an amortized loan can pave the way for a debt-free future. With financial complexities, it’s reassuring to know that a well-managed amortized loan can work toward your financial well-being.