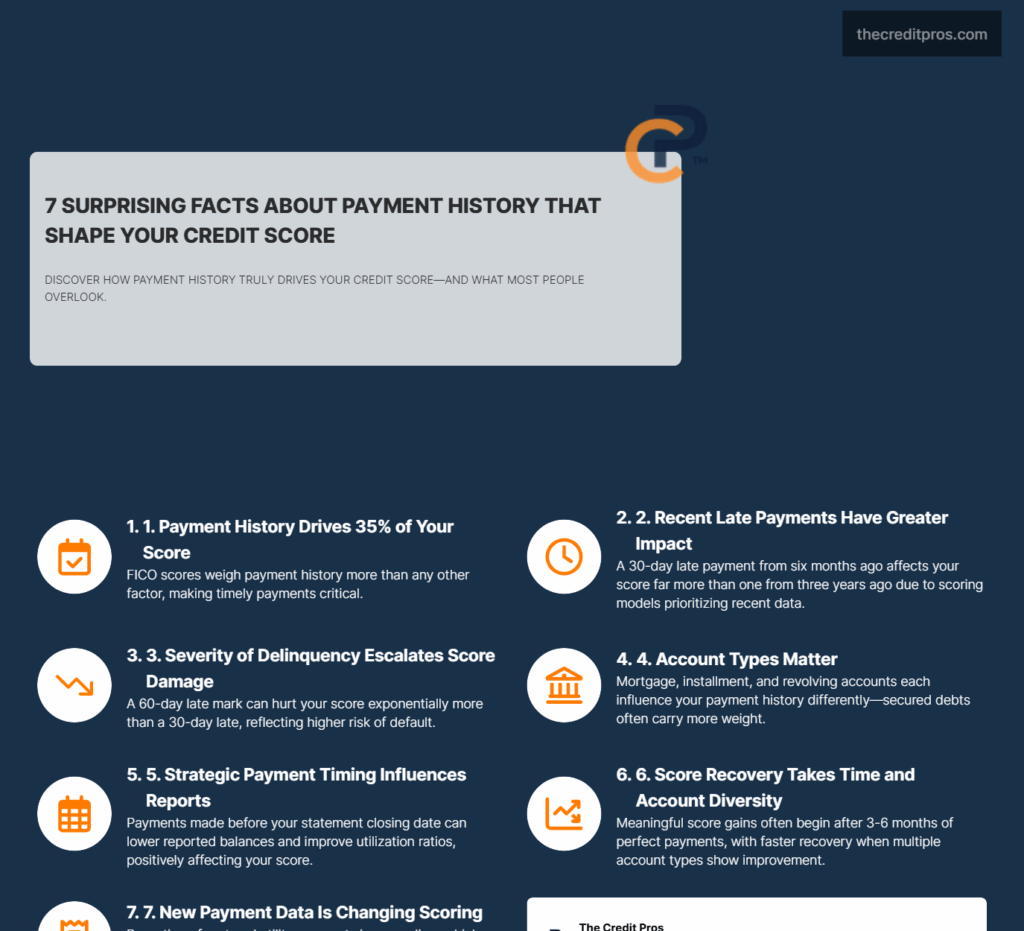

Your credit score hinges on one factor more than any other: payment history credit scores. This single element accounts for 35% of your FICO score, making it the most influential piece of your credit puzzle. Yet most people only scratch the surface of understanding how payment history credit scores actually work. Why does a 30-day late payment hit your score differently than a 60-day delay? How can two people with identical payment records end up with vastly different scores? Understanding the role of payment history credit scores is crucial for anyone looking to improve their financial health.

The mechanics behind payment history scoring are far more complex than simply paying bills on time. Your score doesn’t just track whether you pay—it analyzes when you pay, how you pay, and even the subtle differences between various types of accounts. Some payment strategies that seem identical on paper can produce dramatically different credit outcomes. Understanding these hidden dynamics can mean the difference between a good credit score and an exceptional one, especially when you’re working to rebuild after past credit challenges. Knowing how payment history credit scores function can lead to more strategic financial decisions.

The Hidden Mechanics of Payment History Calculation

The link between your payment history credit scores and your overall financial health cannot be overstated. Maintaining a good payment history credit scores can open up better lending opportunities. Improving your payment history credit scores may take time, but it is achievable with consistency. A diverse account portfolio can positively influence your payment history credit scores.

Payment history operates through sophisticated algorithmic models that extend far beyond simple binary assessments of on-time versus late payments. Credit scoring systems employ complex weighting mechanisms that prioritize recent payment behavior while maintaining memory of historical patterns, creating a dynamic evaluation that shifts as your financial habits evolve. The mathematical foundation treats payment history as a predictive indicator, analyzing patterns to forecast future repayment likelihood rather than merely documenting past performance. This is particularly relevant in understanding payment history credit scores.

Understanding the nuances of payment history credit scores can help mitigate the impact of late payments. By prioritizing on-time payments, you can enhance your payment history credit scores effectively. Understanding how partial payments affect your payment history credit scores is essential for accurate financial management. Even accounts marked as “current” can impact your payment history credit scores depending on payment behavior.

Recent payment patterns carry substantially more weight in scoring calculations than older payment history, following a decay model that gradually reduces the impact of past delinquencies. This temporal weighting means a late payment from six months ago affects your score more significantly than one from three years ago, even if both were identical 30-day delinquencies. The algorithm recognizes that financial responsibility often develops over time, allowing individuals to demonstrate improved creditworthiness through consistent recent behavior.

The distinction between “never late” and “consistently current after past issues” reveals another layer of scoring complexity. Accounts with perfect payment histories don’t automatically receive identical treatment in scoring models. An account that has maintained perfect payments since inception carries different algorithmic weight than one that achieved perfect payments after recovering from previous delinquencies. This differentiation acknowledges that sustained improvement following past challenges can demonstrate stronger financial discipline than accounts that have never faced payment pressure.

Strategizing your payment timing can play a vital role in improving your payment history credit scores. Understanding the relationship between payment timing and your payment history credit scores can enhance your credit profile. Account type variations create additional scoring nuances that affect how payment history is calculated. Mortgage payments, installment loans, and revolving credit accounts each contribute differently to your overall payment history score, with secured debt payments often carrying more weight due to their predictive value for future lending decisions. The scoring model recognizes that successfully managing diverse payment obligations indicates broader financial responsibility than maintaining just one type of account perfectly. Implementing early payments can lead to improved payment history credit scores. Utilizing automated payment systems can help maintain positive payment history credit scores if managed carefully.

Understanding Payment Delinquency: A Graduated Scale of Credit Impact

Recovery from damage to your payment history credit scores requires a comprehensive understanding of scoring models. Understanding how consistent payments improve payment history credit scores can motivate better financial habits. Having a variety of account types can positively influence your payment history credit scores. Maintaining older accounts can be beneficial for your payment history credit scores.

Payment delinquency exists on a graduated scale that creates dramatically different scoring impacts depending on the severity and duration of late payments. The progression from 30-day to 60-day to 90-day delinquencies doesn’t follow a linear scoring penalty structure. Instead, each threshold represents an exponential increase in negative impact, reflecting the statistical correlation between extended delinquency periods and eventual default rates.

Being aware of modern challenges can help in managing your payment history credit scores effectively. Strategies like debt consolidation can affect your payment history credit scores, so it’s important to consider their long-term effects. The critical difference between delinquency periods stems from behavioral economics research showing that consumers who allow accounts to reach 60-day delinquency status demonstrate fundamentally different financial management patterns than those who resolve issues within 30 days. A 30-day late payment might indicate temporary cash flow challenges or administrative oversight, while 60-day delinquencies suggest more systematic financial difficulties. This distinction drives the algorithmic decision to penalize extended delinquencies more severely than their duration alone would suggest.

Understanding how financial hardship programs affect your payment history credit scores is essential for maintaining credit health. Incorporating alternative payment data can potentially enhance the evaluation of your payment history credit scores. Partial payments receive unique treatment within payment history calculations, often falling into a gray area between “current” and “delinquent” status. When you make partial payments, credit reporting systems may show your account as current if the partial payment meets minimum requirements, but the payment pattern still influences your score differently than full payments. The scoring model interprets partial payments as indicators of financial strain, even when accounts technically remain current, because they suggest inability to meet full obligations consistently.

The distinction between “paid as agreed” and “current” status reveals subtle but important scoring differences that many consumers overlook. Accounts marked as “paid as agreed” indicate you’ve met the exact terms of your credit agreement, while “current” status simply means you’re not delinquent. Some accounts may show as current despite not meeting optimal payment patterns, such as making minimum payments on credit cards with high balances. These status variations create different scoring outcomes even when both accounts avoid delinquency.

- 30-day delinquency: Moderate score impact, often recoverable within 3-6 months of resumed payments • 60-day delinquency: Severe score impact, requiring 6-12 months of perfect payments for meaningful recovery • 90-day delinquency: Major score damage, potentially taking 12-24 months to substantially improve • 120+ day delinquency: Extreme negative impact, often leading to charge-off status with multi-year recovery periods

Strategic Payment Timing and Its Underestimated Credit Impact

Payment timing strategies extend beyond meeting due dates to encompass sophisticated approaches that optimize how your payment behavior appears to credit scoring algorithms. The relationship between statement balance reporting and payment timing creates opportunities for strategic credit management that most consumers never consider. Credit card companies typically report account information to bureaus based on statement closing dates rather than payment due dates, creating a window where strategic payment timing can influence how your payment history and utilization appear on credit reports.

Making multiple payments per month can provide significant advantages beyond simple convenience, particularly for individuals managing high credit utilization or working to optimize their credit profiles. When you make payments before your statement closing date, you can reduce the reported balance that affects your utilization ratio while simultaneously demonstrating frequent payment activity. This strategy becomes particularly valuable for individuals with limited credit history, as frequent payments create more data points for scoring algorithms to evaluate your payment reliability.

The strategic advantage of paying before due dates extends beyond avoiding late fees to include positive impacts on credit scoring calculations. Early payments demonstrate proactive financial management and can help establish consistent payment patterns that scoring algorithms recognize as indicators of low default risk. Additionally, early payments provide buffer time for processing delays and reduce the risk of late payments due to technical issues or mail delays.

Automatic payment systems present both opportunities and risks for payment history optimization. While automatic payments virtually guarantee on-time payment history, they can also create complacency that prevents you from monitoring account activity and optimizing payment timing for maximum credit benefit. The most effective automatic payment strategies involve setting up minimum payment automation while maintaining manual control over additional payments and timing optimization.

Credit Score Recovery: The Science of Rebuilding Payment History

Score recovery following payment history damage follows predictable but non-linear patterns that reflect the complex weighting systems within credit scoring algorithms. The initial months following improved payment behavior typically show minimal score improvements, creating frustration for individuals expecting immediate results from their efforts. This delayed response occurs because scoring models require sufficient data to confirm that improved payment patterns represent genuine behavioral change rather than temporary adjustments.

The mathematical relationship between time and score recovery accelerates after establishing consistent payment patterns over extended periods. Most scoring models begin showing meaningful improvements after three to six months of perfect payments, with more substantial gains occurring between six and twelve months. However, the rate of improvement varies significantly based on the severity of previous payment issues and the diversity of accounts demonstrating improved payment patterns.

Account diversity plays a crucial role in accelerating payment history rehabilitation, as scoring algorithms gain confidence in your creditworthiness more quickly when multiple account types demonstrate consistent payment improvement. An individual rebuilding payment history across credit cards, installment loans, and other account types will typically see faster score recovery than someone improving payment history on just one account type. This occurs because diverse payment success indicates broader financial management improvement rather than account-specific behavioral change.

The strategic value of maintaining older accounts with improved payment patterns becomes particularly important during recovery periods. These accounts provide continuity in your credit history while demonstrating long-term commitment to improved financial management. Closing older accounts during recovery can actually slow score improvement by reducing the historical context that helps scoring algorithms evaluate your progress.

Modern Credit Challenges and Payment History Management

Contemporary financial management introduces complexities that traditional payment history models weren’t designed to address, creating new challenges for maintaining optimal payment records. Subscription services and recurring payments have multiplied the number of payment obligations most consumers manage, increasing the likelihood of administrative errors or forgotten payments that can damage payment history. The proliferation of automatic recurring charges across multiple accounts requires more sophisticated financial management than previous generations needed to maintain perfect payment records.

Debt consolidation and balance transfer strategies, while often beneficial for overall financial health, can temporarily disrupt the payment history benefits you’ve built with existing accounts. When you close accounts after transferring balances, you lose the ongoing positive payment history those accounts could have continued generating. Additionally, new accounts created through consolidation start without payment history, temporarily reducing the overall strength of your payment profile until they establish their own positive payment patterns.

The distinction between personal and business credit creates unique challenges for individuals managing multiple credit profiles simultaneously. Payment issues on business accounts can sometimes affect personal credit scores, particularly for sole proprietors or when personal guarantees are involved. Managing payment history across both profiles requires understanding how different types of business credit reporting interact with personal credit scoring systems.

Financial hardship programs offered by creditors present a paradoxical challenge for payment history management. While these programs provide necessary relief during difficult financial periods, they often result in modified payment terms that can appear differently on credit reports than standard “paid as agreed” status. Some hardship programs may report payments as “partial payments” or include special codes that indicate modified terms, potentially affecting how scoring algorithms interpret your payment history even when you’re meeting the modified agreement perfectly.

The emergence of alternative payment data, including utility payments, rent payments, and other recurring obligations, represents a potential shift in how payment history importance may evolve. As credit scoring models begin incorporating this additional payment data, the relative weight of traditional credit payment history may adjust to account for broader payment behavior patterns. This evolution could particularly benefit individuals with limited traditional credit history but strong alternative payment records.

Mastering Payment History: Your Path to Credit Excellence

Payment history credit scores’ 35% weight in your credit score isn’t just about paying bills on time—it’s about understanding the sophisticated algorithms that evaluate when, how, and why you make payments. The hidden mechanics reveal that identical payment behaviors can produce vastly different credit outcomes based on timing strategies, account diversity, and the nuanced differences between delinquency levels. Two people with seemingly identical payment records can have different scores because scoring models analyze payment patterns through complex weighting systems that prioritize recent behavior while considering account types, partial payments, and recovery trajectories.

The journey from understanding these mechanics to optimizing your payment strategy requires patience and precision. Score recovery follows predictable patterns, but the path isn’t linear—it demands consistent execution across multiple account types over extended periods. Modern financial challenges, from subscription proliferation to business credit crossover, add layers of complexity that previous generations never faced. Your payment history credit scores aren’t just a record of your past—they’re a dynamic, evolving predictor of your financial future that responds to strategic management in ways most people never realize.