Most people accept whatever interest rate their credit card company assigns them, treating it as an unchangeable fact. But here’s what many don’t realize: financial institutions actually expect customers to negotiate, and they often build flexibility into their pricing specifically for these conversations. Your current rate might not reflect your true creditworthiness or the value you bring as a customer. By securing lower interest rates, you can significantly reduce your overall debt burden. Negotiating lower interest rates can lead to significant savings, making it easier to manage your finances effectively. Many consumers are unaware that they can request lower interest rates, which can greatly enhance their financial situation.

The difference between someone who pays the assigned rate and someone who successfully negotiates can mean thousands of dollars over time. What separates these two outcomes isn’t luck or special connections—it’s understanding how to position yourself as a valuable customer worth keeping at a better rate. The strategies ahead will show you exactly when to call, what to say, and how to turn your payment history and relationship into negotiating power that actually works to achieve lower interest rates.

Understanding how to negotiate lower interest rates is a crucial skill for anyone looking to reduce their debt burden. Utilizing effective negotiation techniques can often result in lower interest rates, saving you money in the long run. Being proactive about seeking lower interest rates can significantly impact your financial health. Customers who have successfully negotiated lower interest rates often share their experiences to help others. Improving your credit score can also lead to lower interest rates, making it easier to qualify for better terms.

Understanding the market can help you negotiate lower interest rates successfully. Effective communication plays a vital role in achieving lower interest rates during negotiations. Employing strategic communication can lead to favorable outcomes, including lower interest rates. Using documented evidence of lower interest rates from competitors can strengthen your case. Following up on requests for lower interest rates can often result in positive responses. Temporary offers can evolve into permanent lower interest rates if you manage your accounts effectively.

Documenting your negotiations can help ensure you secure lower interest rates in the future. Explaining how a reduction in rates affects your payment strategy can lead to lower interest rates. Staying informed about economic conditions aids in negotiating lower interest rates successfully. Utilizing financial tools to manage repayments can enhance the possibility of securing lower interest rates. Requesting feedback on prior negotiations can provide insights into achieving lower interest rates. Regularly reviewing your accounts can uncover opportunities for lower interest rates. Maintaining a good credit profile is essential for securing lower interest rates in future dealings. Lower interest rates can create a sense of accomplishment in your financial journey. Actively seeking lower interest rates can help you build a more resilient financial framework.

The Psychology of Rate Negotiation: Understanding Your Leverage Points

Engaging in dialogues about lower interest rates can significantly benefit your financial standing. Taking control of your financial narrative involves advocating for lower interest rates actively. Negotiating for lower interest rates reflects informed financial decision-making and responsibility. By focusing on negotiating lower interest rates, you can empower yourself financially and create a better future for your economic health.

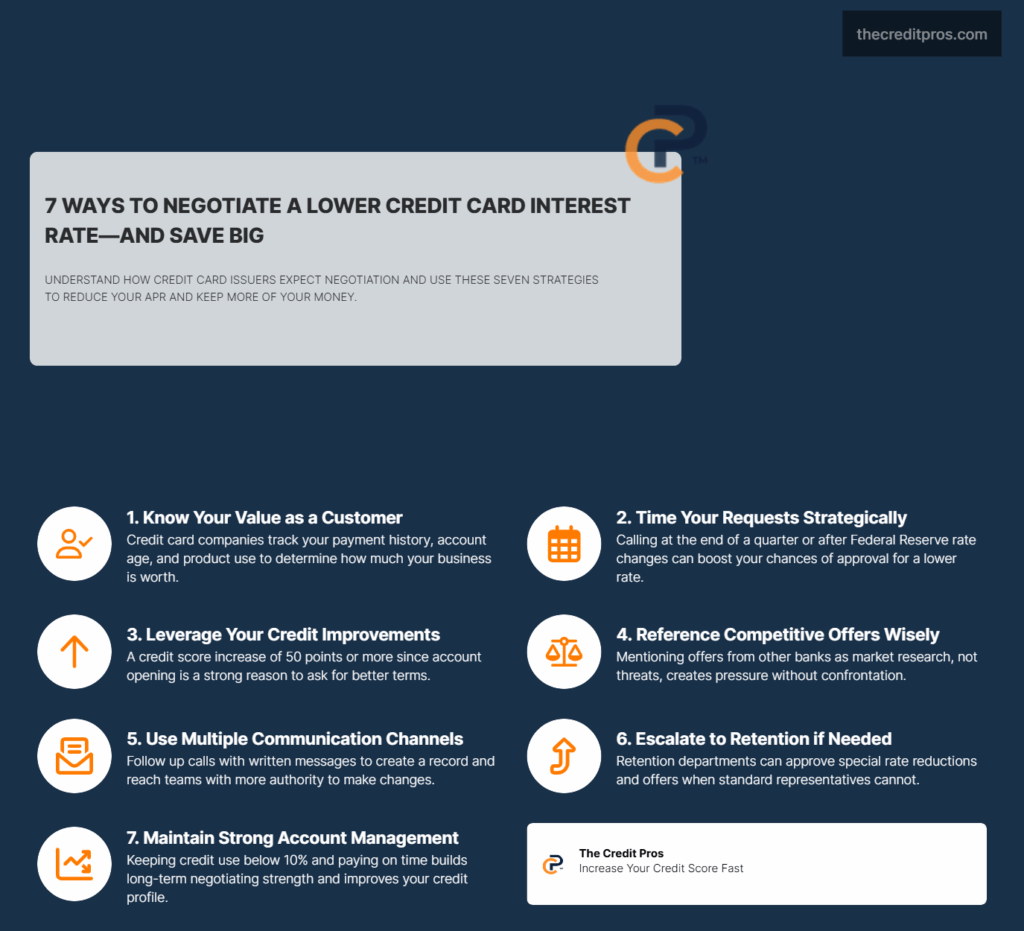

Credit card companies operate on sophisticated customer lifetime value models that assign different worth levels to their cardholders. Your payment history, account longevity, and spending patterns create a detailed profile that determines how much the issuer values keeping your business. Companies track metrics like monthly payment reliability, account age, and total relationship value across all products you hold with them.

The timing of your negotiation request significantly impacts your success rate. Financial institutions experience quarterly pressures to maintain customer satisfaction scores and retention rates. End-of-quarter periods often present optimal windows when customer service departments have more flexibility to approve rate reductions. Additionally, economic cycles influence issuer willingness to negotiate—during periods of tighter credit markets, companies become more protective of existing quality customers.

Your oldest credit card account represents your strongest negotiation foundation because it demonstrates the longest track record of responsible payment behavior. This extended relationship history provides concrete evidence of your reliability as a borrower. When you mention your account tenure during negotiations, you’re essentially highlighting the sunk costs the issuer has invested in acquiring and maintaining your business relationship.

Recent credit score improvements create powerful justification for rate reduction requests because they demonstrate evolving creditworthiness. If your score has increased by 50 points or more since account opening, this improvement suggests you now qualify for better terms than originally offered. The key lies in presenting this improvement as a reflection of your enhanced financial stability rather than temporary good fortune.

Mentioning competitive offers requires careful positioning to avoid creating adversarial dynamics. Rather than issuing ultimatums, frame competitor rates as market research that’s prompted you to evaluate your current terms. This approach acknowledges your loyalty while suggesting you’re conducting due diligence on your financial relationships. The goal is creating gentle pressure without forcing the representative into a defensive position.

Customer service responses often contain subtle indicators of genuine negotiation flexibility versus scripted rejections. Representatives who ask detailed questions about your account history, current financial situation, or specific rate targets are typically exploring available options. Conversely, immediate flat refusals without discussion usually indicate limited authority or restrictive policies for your account profile.

Strategic Communication Techniques for Maximum Impact

Successful rate negotiations require structured approaches that present compelling cases for reduction. The most effective framework begins with acknowledging your positive relationship history, then presents specific justification for the request, and concludes with clear expectations for the outcome. This structure helps representatives understand both your loyalty and your legitimate basis for requesting better terms.

Multiple communication channels can reinforce your negotiation position when used strategically. Following phone conversations with written correspondence creates documentation trails that demonstrate your seriousness about the request. Secure messaging through online banking platforms often reaches specialized customer retention teams with broader authority to approve rate modifications.

Temporary rate reductions frequently serve as pathways to permanent improvements because they allow issuers to test your response to better terms. A six-month promotional rate reduction provides the company with data on your payment behavior and account usage under improved conditions. Consistently demonstrating responsible management during temporary periods often leads to permanent rate adjustments when the promotional period expires.

Ultimately, understanding how to secure lower interest rates leads to improved overall financial security. By learning the strategies for obtaining lower interest rates, you position yourself for future financial success. In conclusion, securing lower interest rates is a fundamental aspect of managing personal finances effectively.

Documentation serves multiple purposes beyond creating paper trails for future reference. Detailed records of conversation dates, representative names, and specific responses help you track which approaches generate positive responses. This information becomes valuable when escalating requests or approaching the same issuer with future negotiation attempts.

The debt avalanche method—prioritizing highest-rate debt for accelerated payoff—provides compelling talking points during negotiations because it demonstrates sophisticated debt management understanding. When you explain how a rate reduction would accelerate your payoff timeline, you’re showing the issuer that you have a concrete plan for debt elimination. This approach positions you as a strategic borrower rather than someone seeking temporary relief.

Business cycle timing affects issuer receptiveness to rate reduction requests in predictable patterns. New fiscal year periods often coincide with updated customer retention budgets and revised pricing strategies. Similarly, periods following Federal Reserve rate adjustments create opportunities to request rate modifications that align with broader market changes.

Advanced Escalation Strategies When Initial Attempts Fail

Escalation strategies become necessary when front-line representatives lack authority to approve meaningful rate reductions. Customer retention departments typically possess broader discretionary powers because their primary mandate involves preventing account closures. Requesting transfer to retention or cancellation departments signals serious intent while accessing personnel with enhanced negotiation authority.

The three-month waiting period between declined requests allows sufficient time for account circumstances to change while avoiding the appearance of harassment. This timeframe also coincides with quarterly performance review cycles that might influence departmental policies or individual representative incentives. Consistent quarterly attempts demonstrate persistence without crossing into problematic territory.

Balance transfer threats require careful calibration to maintain credibility without damaging your credit profile. Researching actual transfer offers from competing issuers provides concrete alternatives that strengthen your negotiation position. However, avoid initiating multiple credit applications during active negotiations, as the resulting hard inquiries can temporarily impact your credit score and undermine your position.

Partial victories often represent stepping stones toward comprehensive rate improvements rather than final outcomes. Accepting temporary rate reductions, annual fee waivers, or enhanced rewards can demonstrate good faith while establishing precedent for future concessions. These incremental improvements also provide additional negotiation capital for subsequent conversations.

Customer retention offers frequently emerge when representatives perceive genuine account closure risk. These specialized promotions might include rate reductions, statement credit, or enhanced benefits packages designed to preserve the relationship. The key to accessing retention offers lies in expressing legitimate dissatisfaction with current terms while maintaining respectful communication throughout the process.

“If you carry a balance on your credit card, a higher interest rate, also called an annual percentage rate (APR), can make it harder to put a dent in your debt. When you make payments on a high-APR card, more of your money goes toward interest, which means it takes longer to chip away at the principal balance.”

“If you carry a balance on your credit card, a higher interest rate, also called an annual percentage rate (APR), can make it harder to put a dent in your debt. When you make payments on a high-APR card, more of your money goes toward interest, which means it takes longer to chip away at the principal balance.”

“If you carry a balance on your credit card, a higher interest rate, also called an annual percentage rate (APR), can make it harder to put a dent in your debt. When you make payments on a high-APR card, more of your money goes toward interest, which means it takes longer to chip away at the principal balance.”

Building Long-Term Negotiating Power Through Strategic Account Management

Building negotiating capital requires consistent demonstration of responsible account management over extended periods. Payment history represents the most significant factor in establishing your value as a customer, but utilization patterns, account growth, and cross-product relationships also contribute to your overall profile. Maintaining utilization ratios below 10% signals sophisticated credit management that extends beyond basic payment obligations.

Credit limit increases serve dual purposes as relationship-building tools and negotiation enhancers. Accepting offered increases demonstrates confidence in your ability to manage expanded credit access while providing the issuer with growth opportunities. Higher credit limits also improve your utilization ratios when spending remains constant, creating positive feedback loops that strengthen your credit profile.

Coordinating negotiations across multiple issuers requires strategic timing to avoid appearing desperate or financially stressed. Successful multi-issuer campaigns typically span several months, with individual conversations spaced sufficiently apart to prevent cross-referencing between institutions. The goal involves creating competitive pressure without triggering risk management concerns that could result in adverse account actions.

Converting rate reduction successes into broader account improvements maximizes the value of your negotiation efforts. Once you’ve established willingness to provide better terms, explore additional enhancements like annual fee waivers, rewards program upgrades, or enhanced customer service privileges. These comprehensive improvements create more valuable relationships that become harder for issuers to replace.

Relationship depth influences negotiation success rates because multi-product customers represent higher switching costs for financial institutions. Customers with checking accounts, savings products, or investment relationships alongside credit cards receive enhanced consideration during retention discussions. This relationship complexity creates natural barriers to customer departure that strengthen your negotiation leverage.

Maximizing Financial Benefits Beyond Rate Reductions

Successful rate negotiations create opportunities for accelerated debt elimination, but only when coupled with disciplined spending behavior. The psychological relief of lower rates can sometimes lead to increased borrowing, which ultimately negates the financial benefits of negotiated improvements. Maintaining strict spending controls ensures that rate reductions translate into faster debt payoff rather than expanded debt loads.

Grace period privileges become powerful financial tools when used strategically to eliminate interest charges entirely. Most credit cards provide 21-day grace periods for new purchases when previous balances are paid in full. Understanding and leveraging these periods allows you to use credit cards for convenience and rewards while avoiding interest charges altogether.

Emergency fund development reduces future dependence on high-interest credit during financial disruptions. The average interest rate on credit card accounts that charge interest was 16.88% as of November 2019, making emergency credit extremely expensive compared to dedicated savings funds. Building three-to-six months of expenses in accessible savings accounts provides alternatives to credit card borrowing during unexpected financial challenges.

Long-term credit score benefits compound when lower interest rates enable faster debt payoff and improved utilization ratios. Reduced debt levels create positive feedback loops that enhance credit scores, which in turn qualify you for better terms on future credit products. This progression transforms one-time negotiation successes into lasting financial advantages that extend far beyond individual credit card accounts.

The strategic approach to interest rate negotiation extends beyond immediate cost savings to encompass comprehensive financial health improvement. Lower rates accelerate debt elimination timelines, reduce monthly payment obligations, and create financial flexibility for other priorities. These benefits accumulate over time, transforming negotiated rate reductions into significant long-term wealth preservation and building opportunities.

Conclusion: Your Path to Financial Empowerment

The difference between accepting your assigned interest rate and actively negotiating better terms isn’t just about saving money—it’s about fundamentally changing your relationship with debt and financial institutions. When you understand that credit card companies expect negotiations and build flexibility into their pricing, you transform from a passive account holder into an empowered financial advocate. The strategies we’ve explored—from leveraging your payment history to timing requests strategically—provide concrete tools that turn your customer value into negotiating power.

These techniques extend far beyond single conversations with customer service representatives. They represent a comprehensive approach to financial management that builds long-term wealth through reduced interest costs, accelerated debt elimination, and improved credit profiles. The psychological shift from accepting whatever terms you’re given to actively pursuing better conditions creates ripple effects that strengthen your entire financial foundation. Your credit card interest rate isn’t a fixed sentence—it’s a starting point for negotiation, and your willingness to engage in that conversation determines whether you’ll pay thousands more than necessary or invest those savings in your financial future.