When you’re shopping for a loan, you’ve probably compared rates at banks and maybe even checked out online lenders. But have you considered credit unions? These member-owned financial cooperatives operate differently than traditional banks, and that difference can translate into real savings and better service for borrowers. While they might not have the flashy marketing campaigns of big banks, credit unions often offer something more valuable: consistently lower interest rates and a more personal approach to lending. Understanding the credit unions loan benefits can help you see why these options may be right for you.

One of the significant credit unions loan benefits is the ability to access lower interest rates, which can make a substantial difference in your overall loan repayment. Another key aspect of credit unions loan benefits is their commitment to community-focused lending practices that prioritize borrower needs. By understanding the various credit unions loan benefits, individuals can make better financial decisions aligned with their long-term goals.

The question is whether these potential benefits outweigh some of the trade-offs you might encounter. Credit unions typically require membership, which can limit your options depending on where you work or live. They might also have fewer branches or less advanced technology than larger banks. But for many borrowers, the combination of lower rates, flexible underwriting, and genuine customer service makes credit unions worth serious consideration. Understanding how these institutions work and what they offer can help you make a more informed decision about your next loan.

These credit unions loan benefits can significantly impact your financial health, especially when applied strategically. Therefore, assessing the credit unions loan benefits thoroughly can lead to advantageous savings over time. It’s crucial to recognize that these credit unions loan benefits extend beyond just lower rates, as they also encompass personalized service. Many borrowers find that the unique credit unions loan benefits can lead to better financial outcomes compared to traditional lenders. Ultimately, the credit unions loan benefits create a compelling case for those looking to make informed borrowing choices. Clients often discover that the credit unions loan benefits facilitate more accessible loan modifications during financial hardships.

Additionally, the credit unions loan benefits include a comprehensive understanding of local economic dynamics. Many members appreciate that the credit unions loan benefits include a collaborative approach in times of financial difficulty. Understanding the credit unions loan benefits can empower borrowers to negotiate better terms aligned with their needs. Credit unions loan benefits are further amplified by their commitment to member-centric service and community engagement. In summary, the credit unions loan benefits highlight essential aspects of financial cooperation and support. Aspects of credit unions loan benefits also include their adaptability to member needs and market changes.

In many cases, the credit unions loan benefits lead to long-lasting partnerships between members and their credit unions. Overall, the credit unions loan benefits can transform the borrowing experience into a more positive journey. Additionally, by evaluating the credit unions loan benefits, potential borrowers can gain insights into how these financial institutions prioritize member satisfaction over profit, leading to a more favorable lending experience. For those seeking to maximize their financial potential, understanding credit unions loan benefits is essential. The growing recognition of credit unions loan benefits among consumers reflects a shift toward more personalized financial solutions. In essence, these credit unions loan benefits form the foundation of why many borrowers prefer credit unions over traditional banks.

Ultimately, the credit unions loan benefits resonate well with those valuing community and personal connection in banking. In conclusion, the numerous credit unions loan benefits make them a strong choice for many potential borrowers. By leveraging the credit unions loan benefits, you can navigate your financial journey with confidence. Remember that credit unions loan benefits are not just about loans; they encompass a broader approach to financial wellness.

The Rate Advantage: Understanding Credit Union Lending Economics

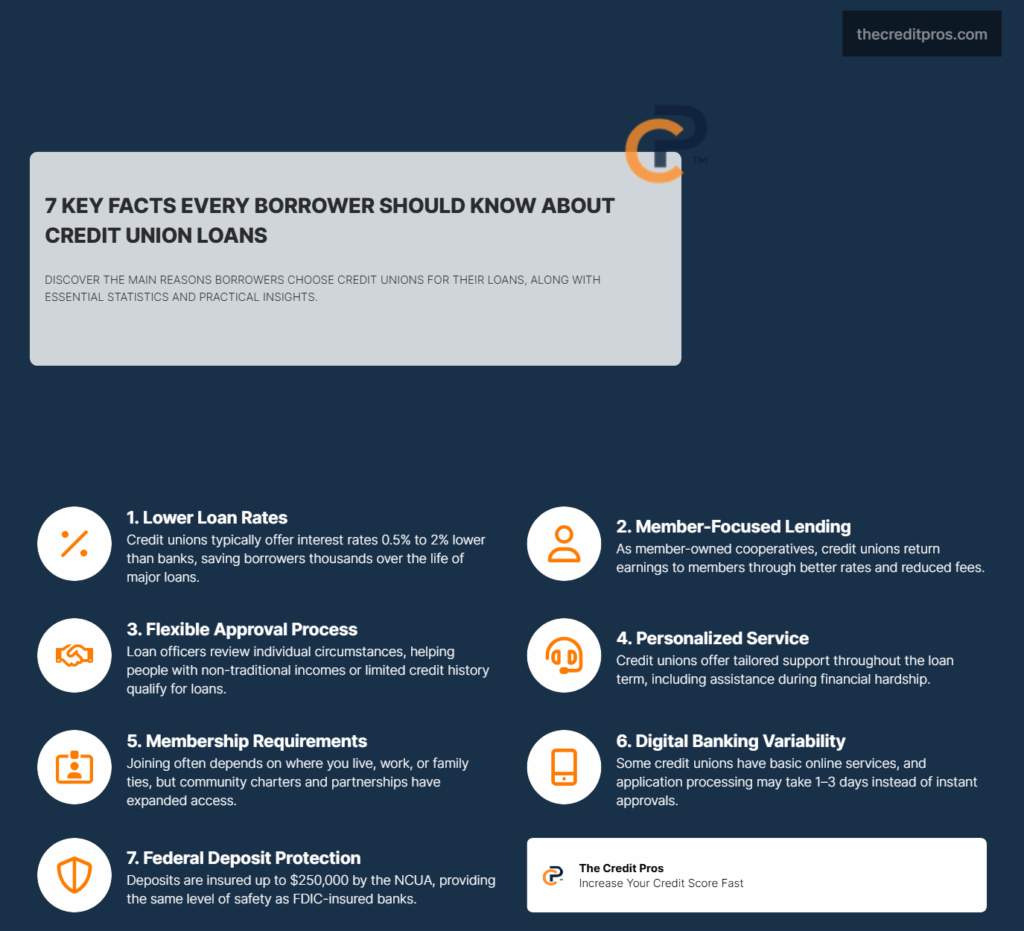

Credit unions consistently deliver lower interest rates across virtually all loan products, with the differential often ranging from 0.5% to 2% below comparable bank offerings. The not-for-profit structure fundamentally alters the lending equation by eliminating the pressure to generate profits for external shareholders. Instead of maximizing revenue through higher interest margins, credit unions operate under a member-dividend model where surplus earnings return to members through improved rates and reduced fees. By understanding the credit unions loan benefits, borrowers can make more informed decisions about their financial options.

The mathematical impact of these rate differences compounds significantly over loan terms. A borrower securing a $25,000 auto loan at 4.5% through a credit union versus 6.2% at a traditional bank saves approximately $1,200 over a five-year term. For mortgage lending, where credit unions frequently offer rates 0.25% to 0.75% below bank averages, a $300,000 home loan could result in savings exceeding $15,000 over the loan’s lifetime. These savings stem directly from the cooperative structure, where member-owners benefit from the institution’s financial success rather than external investors.

Credit unions maintain competitive rates even during economic fluctuations because their capital requirements and profit motivations differ substantially from banks. While banks must satisfy shareholder expectations for consistent returns, credit unions can absorb market volatility by adjusting their member dividend distributions rather than loan pricing. This flexibility becomes particularly valuable during periods of rising interest rates, when credit unions often maintain more stable pricing longer than their bank counterparts.

Regional variations in credit union rate competitiveness reflect local market conditions and membership demographics. Credit unions serving higher-income professional groups, such as educators or healthcare workers, often leverage stronger deposit bases to offer exceptionally competitive rates. Conversely, community-chartered credit unions in economically challenged areas may have less pricing flexibility but still typically outperform local banks due to their operational efficiency and member-focused mission.

Beyond the Numbers: Service Quality and Loan Approval Flexibility

Credit unions approach loan underwriting with a distinctly human-centered philosophy that considers individual circumstances beyond algorithmic scoring models. This personalized approach proves particularly valuable for borrowers with non-traditional income sources, such as freelancers, seasonal workers, or recent graduates. While banks increasingly rely on automated decision-making systems that may reject applications based on rigid criteria, credit union loan officers retain authority to evaluate the complete financial picture and make exceptions based on relationship history and future earning potential.

The community-focused lending criteria employed by credit unions reflect their deep understanding of local economic conditions and employment patterns. A credit union serving a region dependent on agriculture or seasonal tourism industries develops expertise in evaluating income fluctuations that automated bank systems might flag as problematic. This local knowledge translates into more nuanced underwriting decisions that account for regional economic cycles and industry-specific compensation structures.

Credit unions demonstrate exceptional flexibility in loan modification and hardship situations, viewing member financial difficulties as problems to solve rather than risks to minimize. The cooperative ownership structure creates alignment between the institution’s success and member financial well-being, resulting in more collaborative approaches to payment restructuring, temporary forbearance, and workout arrangements. This member-first philosophy extends throughout the loan lifecycle, from initial approval through potential financial challenges.

The relationship banking model prevalent in credit unions creates opportunities for borrowers with limited credit history to establish lending relationships based on demonstrated financial responsibility and community ties. Young borrowers, recent immigrants, or individuals rebuilding credit after financial setbacks often find credit unions more willing to consider alternative credit indicators, such as rental payment history, utility payment patterns, or employment stability. This holistic evaluation process can open lending opportunities that traditional banks might decline based solely on credit score thresholds.

Understanding Credit Union Membership Requirements

As you explore your options, keep the credit unions loan benefits in mind to make the most informed decisions possible. In summary, the credit unions loan benefits contribute to a more valuable and member-centric banking experience. Recognizing the credit unions loan benefits can empower you to take control of your financial future effectively.

Field of membership restrictions represent the most significant barrier to accessing credit union lending benefits, with eligibility criteria varying dramatically between institutions. Traditional occupational credit unions, such as those serving teachers, healthcare workers, or government employees, maintain strict employment-based requirements that exclude potential members outside these professions. Geographic limitations further constrain access, particularly in rural areas where the nearest eligible credit union may be located hundreds of miles away.

The evolution of credit union membership criteria has created numerous workarounds for determined borrowers seeking access to these lending advantages. Community charter credit unions, which serve residents or workers within defined geographic areas, offer broader accessibility than occupational institutions. Additionally, many credit unions allow membership through family relationships, enabling individuals to join if a spouse, parent, or sibling qualifies for membership. Some institutions have established partnerships with professional associations or nonprofit organizations, creating alternative pathways to membership for modest fees.

Employer-sponsored credit unions often provide the most attractive lending terms due to payroll deduction capabilities and reduced default risk. These institutions can offer preferential rates because automatic payroll deductions minimize collection costs and payment defaults. However, employment-based membership creates potential complications during job transitions, as members may face restrictions on new lending products or account services if they leave their qualifying employer.

Membership expansion strategies include:

- Joining professional associations that sponsor credit union partnerships

- Establishing residence in community charter service areas

- Utilizing family member eligibility for membership qualification

- Participating in employer-sponsored credit union programs

- Contributing to qualifying nonprofit organizations with credit union affiliations

The trade-off between exclusivity and accessibility in credit union lending reflects the fundamental tension between serving defined member groups and expanding market reach. While membership restrictions limit access, they also enable credit unions to develop specialized expertise and tailored products for their specific constituencies. This focus allows institutions to offer unique lending programs, such as educator loan products with favorable terms during summer breaks or healthcare worker loans that account for residency training income patterns.

Digital Banking and Convenience Considerations

Digital lending platforms at credit unions often lag behind the sophisticated online application and approval systems deployed by major banks and fintech lenders. Many credit unions, particularly smaller community institutions, rely on shared technology platforms that provide basic functionality but lack the advanced features and instant decision-making capabilities that borrowers increasingly expect. This technological gap can result in longer application processing times and less intuitive user experiences compared to bank competitors.

The loan application and approval timeline differences between credit unions and banks reflect both technological limitations and deliberate service philosophies. While major banks can provide instant pre-approvals for qualified borrowers through automated systems, credit unions typically require one to three business days for initial decisions, even for straightforward applications. However, this extended timeline often includes human review that can identify opportunities to approve borderline applications that automated systems might reject.

Smaller credit unions leverage shared technology platforms and cooperative service organizations to compete with larger institutions’ digital capabilities. The CO-OP Shared Branch network enables members to conduct loan-related transactions at thousands of locations nationwide, effectively expanding the geographic reach of community credit unions. Similarly, shared ATM networks and mobile banking platforms allow smaller institutions to offer services comparable to major banks without the infrastructure investment.

Branch network limitations significantly impact loan servicing convenience, particularly for members who relocate outside their credit union’s primary service area. While shared branching arrangements provide some relief, members may face restrictions on certain loan services or encounter staff unfamiliar with their institution’s specific policies. This geographic limitation becomes particularly problematic for complex loan products, such as mortgages or business loans, which may require specialized expertise not available at all shared branch locations.

The integration challenges between credit union core systems and third-party loan services can create friction in the borrowing experience. Many credit unions partner with external providers for specialized lending products, such as indirect auto loans through dealership networks or mortgage origination services. These partnerships may result in disjointed application processes, delayed funding, or communication gaps that diminish the personalized service experience that credit unions typically provide.

Federal Insurance and Risk Assessment

NCUA insurance provides identical deposit protection to FDIC coverage, insuring member accounts up to $250,000 per ownership category, ensuring that credit union lending relationships carry equivalent safety to bank arrangements. The National Credit Union Administration operates with similar regulatory authority to banking regulators, conducting regular examinations and maintaining insurance fund reserves to protect member deposits. This federal backing eliminates concerns about institutional stability that might otherwise deter borrowers from establishing lending relationships with smaller financial institutions.

Credit union size significantly affects lending capacity and product variety, with smaller institutions often unable to offer the full range of loan products available from larger competitors. Community credit unions with assets under $100 million may lack the capital reserves to fund large mortgage loans or maintain competitive rates across all product categories. Conversely, these smaller institutions often provide more flexible underwriting and personalized service that can benefit borrowers with unique circumstances or challenging credit profiles.

The concentration risk inherent in community-focused lending portfolios creates potential vulnerabilities during economic downturns affecting specific geographic areas or industries. Credit unions serving regions dependent on single industries, such as manufacturing or energy production, face heightened risk when those sectors experience significant contractions. This concentration can impact the institution’s ability to maintain competitive lending rates or continue aggressive growth in loan portfolios during challenging economic periods.

Regulatory differences between credit unions and banks create distinct advantages and limitations for borrowers. Credit unions face less stringent capital requirements than banks, allowing them to maintain higher loan-to-asset ratios and potentially offer more competitive pricing. However, these same regulations limit credit unions’ ability to raise capital through public markets, potentially constraining growth and product innovation compared to bank competitors with access to broader funding sources.

The democratic governance structure of credit unions influences lending policies through member voting on board elections and major policy decisions. This member control can result in lending practices that prioritize member benefits over profit maximization, such as maintaining competitive rates during economic uncertainty or offering specialized loan products for member needs. However, the democratic process can also slow decision-making and policy changes compared to bank management structures with centralized authority.

The Bottom Line: Making the Credit Union Decision

Credit unions present a compelling alternative to traditional bank lending, offering tangible benefits that extend far beyond marketing promises. The consistent rate advantages, ranging from 0.5% to 2% below bank offerings, translate into real savings that compound over loan terms—potentially thousands of dollars for major purchases like homes and vehicles. Combined with their flexible underwriting approach and genuine commitment to member service, credit unions demonstrate that the cooperative model can deliver superior value for borrowers willing to navigate membership requirements.

However, the trade-offs are real and shouldn’t be overlooked. Limited digital capabilities, geographic constraints, and membership restrictions can create friction that some borrowers find unacceptable in today’s fast-paced financial landscape. The key lies in honestly assessing your priorities: if you value personal relationships, competitive rates, and flexible lending criteria over cutting-edge technology and nationwide convenience, credit unions deserve serious consideration. The question isn’t whether credit unions are better than banks—it’s whether their unique advantages align with what matters most to you as a borrower.